The post New repayment scheme in Singapore to help borrowers pay off unsecured debts appeared first on CEO SUITE.

]]>A new repayment scheme that aims to help over-indebted customers repay unsecured loans from facilities like credit cards, personal loans and overdrafts will be launched next Monday (Jan 23).

Under the new scheme, a customer can consolidate all his/her unsecured credit balances across the 14 banks with just one institution.

This means that the bank that administers the DCP will “buy over” the customer’s outstanding balances, fees and interest charges from his existing accounts with other banks. Those accounts will then be suspended or closed.

The scheme will offer borrowers a convenient mode of payment for daily financial needs and includes an unsecured credit of one month’s income.

This new repayment scheme follows the Repayment Assistance Scheme (RAS) which expired in December 2015. The RAS only offered lower interest rates and an eight-year repayment period for amounts in excess of 12 times a borrower’s income, whereas the DCP will cover all of a borrower’s unsecured credit balances.

About 11,000 applications for the RAS were received, with 6,000 of them approved by the time the scheme closed.

Reference: www.channelnewsasia.com

The post New repayment scheme in Singapore to help borrowers pay off unsecured debts appeared first on CEO SUITE.

]]>The post Corporate taxation and Employers’ Mandatory Contributions in Korea appeared first on CEO SUITE.

]]>

By Joseph Zoh

Tax and Financial Services Expert in Korea,

in partnership with CEO SUITE for clients’ tax and financial requirements.

[email protected]

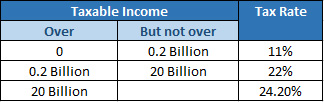

1. Corporate Income Tax (11% / 22% / 24.2%)

Rates are accumulated for up to EBT (Earnings Before Tax) of 0.2 billion Korean Won at 11%, at 22% if it is less than 20 billion Korean Won, and at 24.2% with earnings of more than 20 billion Korean Won.

For an EBT of 30 billion Korean Won, your tax calculation shall be

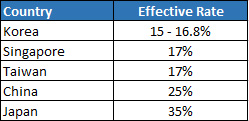

How does this compare with other Asian cities?

When are Corporate Income Taxes due?

Within 3 months after the fiscal year ends (if the fiscal year end falls in December, the returns are expected to be filed by March the following year). All business entities are required to file an interim return by August through a qualified public Tax agency.

2. Value Added Tax (VAT)

VAT rate is at 10% for any purchases other than land, raw farming/fishery products, and this can be reimbursed if they form part of the business expense via a quarterly filing.

3. Social Security Program (SSP)

Part of mandatory contributions when an organization hires in Korea (whether it is a regular employee, periodic, part-timers, or freelancers). According to the regulation, employees will bear half of the National Pension, National Health and Unemployment Insurance Premium while the other half will be borne by the employer. This cost stands at about 8 to 10% of total labor costs (salary, wage and other employee income).

4. Retirement Fund (RF)

An additional labor-related expense when any one of the employees (regular, periodic, part-timers) have served more than a year. The Retirement Fund is equivalent to a month of salary per year, which is usually about 8.34% of the annual salary or wage.

The post Corporate taxation and Employers’ Mandatory Contributions in Korea appeared first on CEO SUITE.

]]>